Understanding Quitclaim Deeds: A Comprehensive Guide

A quitclaim deed is a legal document often used to give someone else ownership or an interest in real estate. It does not come with the usual warranties that other property deeds do. People in Arlington who want to sell their homes might consider using a quitclaim deed because it is easy to understand.

This kind of deed gives the buyer any rights the seller has to the property. However, it doesn’t promise that the title is free of liens or other claims. People in the same family often use quitclaim deeds to add someone to the title or transfer property between spouses.

People who want to buy or sell a home in Arlington should know that a quitclaim deed makes the process quick and easy, but it doesn’t protect against possible title defects. As a result, everyone involved should do their research carefully and think about getting title insurance to protect their rights during the quitclaim deed transaction process.

Comparing Quitclaim Deeds to Warranty Deeds: Key Differences

To sell a house in Arlington, you must know the difference between quitclaim deeds and warranty deeds. A quitclaim deed gives away the seller’s interest in the property, but it doesn’t make any promises or guarantees about the status of the title.

People who buy something can’t hold the seller responsible if there are problems with the title, like liens or claims from other people. These deeds are often used between family members or to clear up problems with the title, but buyers should be aware that they don’t protect them so that they can be risky.

On the other hand, a warranty deed gives buyers more peace of mind by proving that the seller legally owns the property and has the right to sell it. This type of deed ensures that there are no hidden claims or liens on the property.

Warranty deeds are usually better for formal sales or deals involving third parties because they protect against future disagreements about who owns the property and any problems with the title. By understanding these important differences, sellers can choose the type of deed that best meets their needs when selling a home in Arlington.

Legal Implications of Using a Quitclaim Deed in Real Estate Transactions

When you use a quitclaim deed to sell your Arlington home, there are legal implications that both buyers and sellers should be aware of. A quitclaim deed is usually used to give someone else property ownership without guaranteeing a clear title. This means that the seller gives up any rights they may have to the property, but doesn’t promise there aren’t any liens or claims on it.

People who already trust each other, like family members or people getting a divorce, often use this type of deed. Using a quitclaim deed in a normal real estate deal could be risky for the buyer because it doesn’t offer as much protection as a warranty deed, which guarantees a clear title and legal ownership.

Buyers should do extensive research before buying a house. This should include searching the title and maybe even getting title insurance to ensure there aren’t any problems with the property’s history that haven’t been disclosed. In contrast, sellers should know that a quitclaim deed greatly lowers their responsibility, but they must ensure everyone knows the limits of such deals.

Knowing these legal effects can help people considering this method of transferring property rights in Arlington make smart choices. For guidance specific to your needs, contact Southern Hills Home Buyers, a trusted resource for navigating quitclaim deeds and other real estate legal matters in Texas.

Benefits and Risks of Using a Quitclaim Deed in Property Sales

People who want to sell their Arlington home should consider the pros and cons of using a quitclaim deed. One great thing about a quitclaim deed is how easy and quick it is to use. This makes it a good choice for transferring property between family members or for divorce settlements.

Quitclaim deeds eliminate much of the paperwork associated with traditional property transfers. This speeds up the process, which can be especially helpful when time is of the essence. However, there are big risks associated with this ease, especially in normal real estate deals.

Quitclaim deeds, on the other hand, don’t protect against liens or claims on the property or guarantee clear title ownership. People who want to buy something might be hesitant to accept a quitclaim deed because it doesn’t guarantee the seller has full ownership rights.

Because there is no legal protection, problems like hidden liens or taxes that are past due could arise after the transfer is complete. If a seller in Arlington is thinking about using a quitclaim deed, they should make sure that everyone is aware of these restrictions. They may also want to talk to a real estate lawyer to avoid problems and check the property’s title status before proceeding with the deal.

Step-by-Step Process for Selling Property with a Quitclaim Deed

There are a few important steps you need to take before you can use a quitclaim deed to sell your Arlington, TX, house faster. First, it’s important to know that a quitclaim deed only transfers your interest in the property. It doesn’t guarantee that the title is free of claims or encumbrances.

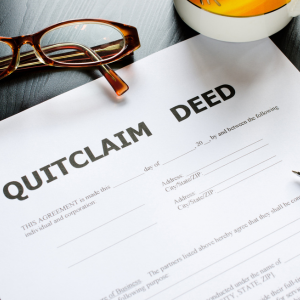

First, get a blank quitclaim deed form and ensure it meets the requirements of the state of Texas. Fill out the form correctly with the names of the grantor and grantee, a description of the property, and any other information that is asked for.

To ensure the document is real, both parties should sign it before a notary public. A quitclaim deed is a legal document often used to give someone else. This makes the transfer a public record.

At this point, it’s a good idea to pay any recording fees that apply. Talking to a real estate lawyer can help make sure that all the legal issues are taken care of and that everyone knows what their rights and responsibilities are in the deal facilitated by a quitclaim deed.

How to Transfer Property Ownership with a Quitclaim Deed

Before you use a quitclaim deed to change who owns a piece of property in Arlington legally, you should make sure that the following things are done: According to the law, a quitclaim deed is a document that helps one person (the grantor) give property rights to another person (the grantee).

This type of deed is often used when both parties trust each other, like when family members or people getting a divorce settle their differences. It doesn’t guarantee a clear title; it just gives the grantor’s interest to the new owner. To begin this process, a quitclaim deed must be written with specifics about the property and both parties.

It needs to be clear that the goal is to change ownership without a promise of no liens or other claims on the property. Finally, everyone who needs to sign the paper must do so in front of a public notary to show that it is real.

When legally changing ownership, you must record the quitclaim deed with the Arlington County Recorder’s Office. This makes sure that there is a correct public record. To ensure everyone is safe, this recording step officially shows that the property rights have changed hands, as Texas law requires.

Common Misconceptions About Quitclaim Deeds in Real Estate

When it comes to selling an Arlington home, many people have the wrong idea about how to use quitclaim deeds. They think that a quitclaim deed can be used like a warranty deed to ensure the title is real and give someone full ownership.

A quitclaim deed only gives away the grantor’s right to live on the property. It doesn’t promise or guarantee that the title is clear. In other words, a quitclaim deed will not get rid of any liens or claims that are on the property.

People also believe that using a quitclaim deed to sell your home makes the process easier and faster since it needs less paperwork and formalities. Quitclaim deeds are easier to fill out, but they shouldn’t be used for normal real estate sales where the buyer expects a clear title and protection against future claims.

Quitclaim deeds are usually used to settle family disputes or move property from one person to another. They are not used to sell homes on the open market. People in Arlington who want to sell their homes should be aware of these rules and talk to a lawyer before using a quitclaim deed instead of more common methods.

State-Specific Rules for Quitclaim Deeds: What You Need to Know

When you want to use a quitclaim deed to sell your Arlington home, it’s important to know the Texas laws that govern this type of property transfer. A quitclaim deed is usually used to move property from one family member to another, fix problems with the title, or add or remove a person from the title.

It is important to keep in mind, though, that quitclaim deeds do not guarantee the property’s title like warranty deeds do. In Texas, you must follow certain legal steps to sign a valid quitclaim deed.

The grantor must sign the deed in front of a notary public for it to be valid. Texas does not charge real estate transfer taxes on quitclaim deeds where no money is exchanged, but there may be local recording fees when the deed is filed with the county clerk’s office.

It’s also important for both parties to know that a quitclaim deed will only transfer the grantor’s interest in the property at the time of transfer. Any liens or other claims against the property will still be there. So, talking to a real estate lawyer who knows Texas law can help you ensure that all the right steps are taken and that any risks are kept to a minimum when you use a quitclaim deed to sell your Arlington home.

Tax Considerations When Transferring Property with a Quitclaim Deed

When transferring property in Arlington using a quitclaim deed, it’s important to consider the tax implications associated with this type of transaction. A quitclaim deed transfers ownership without any warranties or guarantees about the property’s title, which can affect how the transfer is viewed for tax purposes.

In many cases, a quitclaim deed could be considered a gift, triggering potential gift tax liabilities if the value exceeds certain thresholds set by the IRS. It’s essential to evaluate whether this transfer will impact capital gains taxes, especially if you’re selling your Arlington home and not simply gifting it.

Additionally, local and state transfer taxes may apply when recording the quitclaim deed with Arlington’s local government offices. Consulting with a tax professional can clarify these issues and ensure compliance with all relevant tax regulations when transferring property using a quitclaim deed in Arlington.

Potential Challenges When Selling Your House with a Quitclaim Deed

When selling your Arlington home using a quitclaim deed, you may encounter several potential challenges that can complicate the transaction. A quitclaim deed is often used to transfer property ownership without making guarantees about the title’s status, which can raise red flags for potential buyers and their lenders.

Because it offers no warranty of a clear title, buyers might be hesitant to proceed without additional assurances, such as a thorough title search or title insurance. This can lead to delays in the closing process as parties work to verify ownership and resolve any outstanding liens or claims against the property.

Lenders may also be reluctant to finance a purchase involving a quitclaim deed due to the increased risk of title defects, potentially limiting your pool of prospective buyers. Furthermore, because quitclaim deeds are more commonly associated with intra-family transfers or clearing up title issues rather than traditional sales, some real estate agents and attorneys might advise against their use in standard home sales, suggesting instead a warranty deed to provide greater security for all involved parties.

Ensuring a Clear Title with a Quitclaim Deed: Best Practices

When selling your Arlington home using a quitclaim deed, ensuring a clear title is crucial to avoid potential legal disputes or complications. A quitclaim deed is a legal instrument that transfers any interest the grantor has in the property without guaranteeing that the title is free of encumbrances or defects.

Therefore, it is essential to conduct a thorough title search before proceeding with the transaction to identify any liens, mortgages, or other claims against the property. Engaging a professional title company or real estate attorney can enhance due diligence efforts and provide peace of mind.

Additionally, obtaining title insurance can offer protection for both parties against unforeseen issues that may arise after the sale. By following these best practices, you can facilitate a smoother transfer process and ensure that all parties are aware of the property’s status before finalizing the sale with a quitclaim deed in Arlington.

Can You Sell Property with a Quit Claim Deed in Texas?

In Texas, selling property with a quitclaim deed is possible, but there are important considerations to keep in mind. A quitclaim deed transfers whatever interest the grantor has in the property without any warranties or guarantees about the title’s validity.

This means that when selling your Arlington home using a quitclaim deed, the buyer receives no assurance that there are no other claims against the property. While it is legal to sell real estate with a quitclaim deed in Texas, it may not provide the buyer with sufficient confidence regarding the property’s title status.

Therefore, quitclaim deeds are typically used between parties who trust each other, such as family members or close acquaintances. Warranty deeds are preferred for most traditional real estate transactions, especially those involving strangers or significant sums of money, due to their guaranteed protection and clear conveyance of ownership rights.

If you decide to sell your Arlington home through a quitclaim deed, it is crucial to consult with a real estate attorney. Southern Hills Home Buyers can help ensure all legal requirements are met and both parties understand the implications of this type of transaction.

Can You Use a Quit-Claim Deed to Sell Property?

When considering selling your Arlington home, it’s important to understand the role of a quitclaim deed in the process. While a quitclaim deed can transfer interest in a property, it is typically used to clarify ownership rather than facilitate traditional real estate sales.

This legal document allows a homeowner to relinquish their claim or interest without providing any warranty of title. In Arlington, using a quitclaim deed could be appropriate for transferring property between family members or resolving title issues, but it does not guarantee a clear title to potential buyers.

When selling your home on the open market, a warranty deed is generally recommended as it assures the buyer that the seller has valid ownership and the right to sell. Therefore, while you can technically use a quitclaim deed to sell an Arlington property, it may not offer the assurances required by most buyers and lenders.

For homeowners looking to sell their properties effectively and securely, consulting with a real estate attorney or professional might provide guidance on using more suitable methods, such as warranty deeds or other conventional real estate transactions.

What Are the Disadvantages of a Quit-Claim Deed?

When considering selling your Arlington home using a quitclaim deed, it’s crucial to understand the potential disadvantages associated with this type of property transfer. A quitclaim deed offers limited protection to the buyer, as it does not guarantee a clear title or ownership rights.

This lack of warranty means that any existing liens, encumbrances, or claims against the property are not addressed, potentially leaving the buyer vulnerable to future legal issues. Additionally, because quitclaim deeds offer no assurance that the seller actually holds a valid title to the property, they are less favorable in traditional real estate transactions.

Lenders and financial institutions often view quitclaim deeds with skepticism, which can complicate financing or refinancing efforts for both parties involved. In Arlington’s competitive real estate market, using a quitclaim deed might deter potential buyers who seek more security and assurance in their investment.

Therefore, while a quitclaim deed can be a quick way to transfer ownership between familiar parties, such as family members or spouses, during divorce proceedings, it is generally not advisable for standard home sales, where full title insurance and warranty deeds provide better protection and peace of mind.

When Can a Quitclaim Deed Not Be Used?

When considering selling your Arlington home, it’s important to understand when a quitclaim deed may not be suitable. A quitclaim deed is often used to transfer property between family members or remove a spouse’s name after divorce, but it lacks the guarantees of a warranty deed.

Consequently, a quitclaim deed should not be used when the buyer requires assurance about a clear title and absence of liens, typical concerns for potential buyers in an open market sale. If you’re selling to someone who demands certainty about the property’s title history, such as in traditional home sales, a quitclaim deed is inadequate.

It does not provide warranties regarding encumbrances or even true ownership; thus, it cannot assure the buyer of legal protection against future claims. Understanding these limitations is crucial when determining how to sell your home for cash in Dallas, TX, and nearby areas effectively.

Would you like to sell your house? Whether you need to sell fast, avoid expensive repairs, or just want a smooth sale, help from Southern Hills Home Buyers is at hand. We take care of everything, make a reasonable cash offer, and simplify everything. Are you prepared to sell, or do you have any inquiries? Get a free quote by calling (214) 225-3042. Begin right now!

Helpful Arlington Blog Articles

- Navigating HOA Fees At Closing In Arlington, TX

- Sell Your Home with A Quitclaim Deed in Arlington, TX?

- Selling Distressed Properties Fast In Arlington, TX

- Divorce Home Appraisal Services In Arlington, TX

- Sell Your Arlington Home When Behind On Mortgage Payments

- Foundation Crack Repair Costs In Arlington, TX

- Evicting A Sibling From Inherited Property In Arlington, TX

- Understanding Closing Costs for FSBO Home Sales in Arlington, TX

- Selling Old House in Arlington, TX

- Selling Rental Property at a Loss in Arlington, TX

| REAL ESTATE LAWYER | REAL ESTATE LAW | OWNERSHIP INTEREST | LEGAL SERVICES | LAWYER | HOME LOAN |

| HOMEBUYING | MORTGAGE LENDING | DOCUMENTS | REAL PROPERTY | REALTY | CREDITORS |

| PROPERTY TITLE | INSURANCE COMPANIES | INSURANCE COMPANY | LENDING | LEGAL ASSISTANCE | COVENANTS |

| NOTARIZATION | LEGAL DOCUMENTS | ESTATE LAW | PROPERTY LAWS | PAYMENT | PAYMENT METHODS |

| FORECLOSE | FORECLOSURE | ESTATE PLANNING | SIGNATURE | PROBATE | HEIRS |

| HEIRSHIP | EXPERT | DOCUMENTATION | TENANTS IN COMMON | JOINT TENANTS | TENANTS BY THE ENTIRETY |

| LIVING TRUST | STATUTE | PRICE | MARRIAGE | LANGUAGE | DEED A QUITCLAIM |

| QUITCLAIM DEED AND | TRANSFER THE PROPERTY | DEEDS IN TEXAS | THE PROPERTY IS | THAT THE GRANTOR | TYPES OF DEEDS |

| A GENERAL WARRANTY DEED | INTEREST IN THE PROPERTY | A QUITCLAIM DEED AND | IS A QUITCLAIM DEED | WHAT IS A QUITCLAIM | DEED A QUITCLAIM DEED |

| TO TRANSFER THE PROPERTY | LEGAL DOCUMENT THAT TRANSFERS | A WARRANTY DEED WHICH | THAT THE GRANTOR OWNS | THE GRANTOR OWNS THE |