Dealing with tenants who are behind, on rent can be a tricky situation for any property owner especially when you’re looking to sell your home in Houston. As a homeowner, it can feel overwhelming trying to navigate through the eviction process, local regulations, and lease agreements. This guide is here to offer you the resources and knowledge to effectively handle this issue. Our goal is to simplify the complexities surrounding evictions, provide support, and introduce options like Southern Hills Home Buyers. By the end of this guide, you’ll have strategies to sell your property efficiently and lawfully even amidst an eviction scenario.

Selling A House With Tenants Not Paying Rent

When selling a property with tenants who aren’t paying rent various obstacles may come up. As a landlord, you must abide by the laws and the terms of your lease agreement. Depending on whether it is a fixed-term lease or a month-to-month rental agreement the eviction process can vary. Additionally, if tenants enforce their rights as renters things can get more complex.

If you’re facing foreclosure due to rent payments, remember that legal protections are in place for you. Dealing with the eviction process can be an expensive ordeal impacting both the selling process and your financial outcome.

Navigating Tenant Eviction While Selling

Selling your investment property while dealing with tenants who are not paying rent adds another layer of complexity to a situation. As a property owner, you must strike a balance between enforcing the lease agreement and ensuring that the property maintains its market value for buyers. When starting an eviction process it is crucial to follow state laws and provide notice. Typically a 30-day notice for month-to-month leases or as outlined in your fixed term lease agreement.

Furthermore when selling a property that is currently rented out it is important to be transparent with buyers about the tenant situation. Open communication about the eviction status and timeline can help avoid issues with the owner who will need to honor the existing tenant’s lease until its conclusion. On the other hand, some homebuyers may see this as an opportunity, especially for real estate investors who may plan to manage the rental property themselves. Moreover, offering incentives to tenants to leave, such as a gift card or part of their security deposit, could contribute to a more cooperative resolution.

This method helps simplify things for everyone involved. Could speed up the selling process allowing you to showcase the property as empty which is often more attractive to buyers.

Tenants Rights When Selling A House

Tenant rights differ significantly depending on the state. All tenants have fundamental rights when the property they are renting is sold. Typically a tenant has the right to remain in the property until their lease ends even if ownership changes. This can be overridden only if there is a termination clause in the lease allowing the landlord to end it prematurely when selling.

For example in California month to month tenants must receive a 30-day notice if the landlord plans to sell. If a tenant has rented for over a year a 60-day notice is necessary. In some states, the new owner must honor the existing tenant’s lease unless they plan to use it as their residence.

Moreover, tenants should be given notice before potential buyers view the property. Typically this notice period is set at 24 hours. However, the exact duration may differ depending on regulations. Regardless of the circumstances, it’s important to have communication with your tenants regarding your decision to sell and try to find a beneficial solution that respects both their rights and your responsibilities as a property owner. For instance, some landlords might offer incentives like reduced rent or gift cards to encourage cooperation during the sales process.

Tenants Rights When Selling A House (If They’re Not Paying Rent)

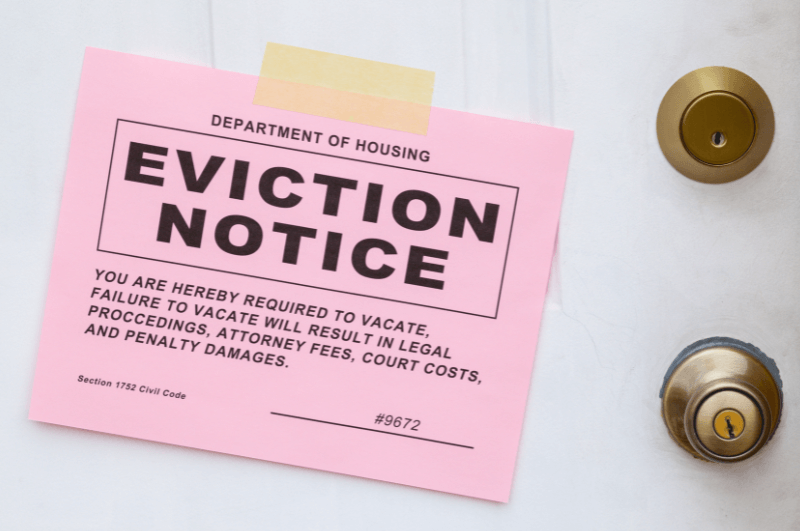

When dealing with tenants who are behind on rent payments their rights in the selling process can be somewhat altered. Landlords have the right to initiate eviction procedures in accordance with state laws. Typically this process begins with a demand for payment in the form of a ‘pay or vacate’ notice. If the tenant fails to pay within the timeframe the landlord can proceed with an eviction lawsuit.

During eviction proceedings, landlords are required to give notice to tenants before showcasing the property to potential buyers. The tenant’s entitlement to receive their security deposit back remains unaffected. If the house is sold this deposit is passed on to the owner.

When faced with an eviction situation considering selling to home buyers or real estate investors, those who advertise ‘we buy houses in Fort Worth‘ can provide a quick solution. They often purchase properties ‘as is,’ including investment properties that come with tenant-related issues. It’s crucial to adhere to state laws, throughout the sales and eviction process to safeguard the rights of both the property owner and the tenant.

How To Deal With Non-Paying Tenants

Dealing with tenants who fail to pay rent can be a source of concern for property owners. However, there are strategies you can use to address this issue effectively.

First and foremost effective communication is essential. Reach out to your tenant to understand their reasons for not paying rent. They may be experiencing difficult times and finding a mutually agreeable payment plan or grace period could be beneficial.

If communication fails to yield results it may be necessary to issue a formal ‘pay or quit’ notice. This legal document provides the tenant with a timeframe within which they must pay their rent or vacate the premises. The content and deadlines of this notice vary depending on regulations so it’s important to familiarize yourself with the laws in your state.

If your renter still doesn’t pay after getting the notice you might need to begin eviction procedures. Eviction must be carried out legally. Following state regulations usually involves initiating a lawsuit in court.

Additionally, consider reaching out to a property management firm or a real estate agent, for guidance. These professionals can assist in navigating the complexities of eviction laws and provide tips on managing tenants.

Don’t overlook the possibility of selling your property with tenants to a real estate investor. These buyers often acquire properties in their condition, including those with tenants, which could save you the trouble and expenses of eviction proceedings.

How Long To Evict A Non-Paying Tenant

The duration for evicting a paying tenant can vary significantly from case to case. However, having an understanding of the timeline can help set expectations. As a landlord, it’s advisable to initiate the eviction process as per your state’s regulations typically after rent becomes overdue by a specified number of days.

In Texas, landlords can begin the eviction process shortly after rent is due and unpaid although many opt to wait a few days to a week in case the tenant pays late. The actual eviction procedure can be quite lengthy. After delivering a 3-day ‘pay or quit’ notice, to the tenant, they are given three days to either settle the rent or vacate the premises. If the tenant fails to comply you can then initiate an entry and detainer lawsuit in your Justice of the Peace precinct which might take anywhere from a few weeks to several months depending on the court workload and how the tenant responds. Following this the tenant will have five days to respond to the lawsuit. If they do not respond a default judgment may be issued in your favor expediting things slightly. However, if they decide to contest the eviction by responding a trial will be scheduled, adding time to the process.

It’s important to note that this is an overview and that various factors such as legal holidays, court delays, and specific case circumstances can affect how long an eviction process actually takes.

Make sure to seek advice, from an expert or a real estate lawyer who has experience with evictions to ensure you are complying with all laws and rules.

Can I Sell A Property With A Tenant Living In It?

Yes, it is possible to sell a property even if there is a tenant living in it. However, this process can be complex due to tenant rights. In some states, the lease agreement between the owner and the tenant remains valid even after the property is sold. The new buyer is obligated to honor the lease terms until its expiration. For month-to-month leases, the new landlord can end the lease by giving notice 30 days.

Selling a property with tenants might attract types of buyers like real estate investors seeking properties with existing tenants. Nevertheless, it’s crucial to understand that some potential buyers may be hesitant about taking on a lease or managing existing tenants. This could reduce the number of buyers. Potentially impact your property’s market value.

In some situations, the tenant might express interest in buying the property themselves. If the situation differs it might be helpful to provide incentives such as a rent reduction or a gift card to encourage the tenant’s cooperation during the selling process.

Selling a property with tenants in place may involve some effort compared to selling a property but with the right approach and resources, it can be handled effectively. It’s wise to seek assistance from an estate agent or property management expert with local regulations and the rental market. They can offer guidance. Help navigate the selling process smoothly.

Pros And Cons Of Selling An Occupied Property

Every real estate deal presents its challenges and benefits and selling a property with tenants is no exception. There are pros and cons to weigh when embarking on this endeavor. Understanding these aspects can assist property owners in making informed choices and managing the process effectively.

Pros of Selling a Tenant-Occupied Property:

- Steady Income: Even while you’re in the midst of selling you’ll still receive rental income from the property, which can assist in covering expenses, like upkeep, property management, and any mortgage payments.

- Attracting Investors: When it comes to attracting investors, having tenants in place can catch the eye of certain buyers. Real estate investors are looking for rental properties that generate consistent income.

- Less Maintenance: Having tenants typically means they take care of day-to-day property maintenance easing the workload for the owner.

Cons of Selling a Tenant-Occupied Property:

- Limited Pool of Buyers: Not all buyers are keen on purchasing a property with existing tenants, which could narrow down the pool of buyers and impact the property’s market value.

- Time Constraints: Respecting tenant rights during the sale process, such as providing notice before showings and inspections can complicate scheduling.

Potential for Conflict: The selling process may stress out tenants leading to conflicts that slow down sales and create unnecessary complications.

Conclusion

Taking into account both the advantages and disadvantages of selling a tenant-occupied property one possible solution could be to sell to a cash home buyer, like Southern Hills Home Buyers. This alternative approach could help address some of the challenges associated with sales methods.

Southern Hills Home Buyers, a real estate investor provides a hassle-free selling process. They have expertise in dealing with properties that have tenants and can handle the complexities of regulations, tenant rights, and eviction timelines, with professionalism and effectiveness. Moreover, they offer a market value for properties to ensure sellers receive a return on their investment. Choosing to sell to a cash buyer like Southern Hills Home Buyers allows landlords to avoid issues such as buyer options, time constraints, and potential conflicts allowing them to smoothly transition out of their situation with minimal stress. Therefore selling to Southern Hills Home Buyers could be the choice for landlords looking for a smooth and profitable exit from their tenant-occupied property.

DISCLAIMER: This article is meant for educational purposes only and is not intended to be construed as financial, tax, or legal advice. Southern Hills Home Buyers always encourages you to reach out to an advisor regarding your own situation.