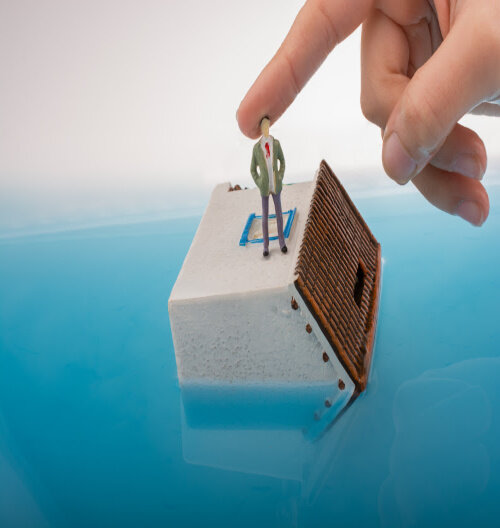

The Complete Guide To Selling A House With Flood Damage In Texas

It’s critical to take immediate action and limit damage if your Texas home has been flooded. The damage might worsen and get more expensive the longer you wait.

The first step is to immediately shut off all electricity and gas to avoid any potential hazards. Then, remove any standing water using pumps or wet vacuums.

It is also important to begin drying out the affected areas by opening windows and using fans and dehumidifiers. Make sure to document all damages for insurance purposes and dispose of any damaged items properly.

Additionally, consider hiring a professional restoration company to assess the extent of the damage and provide assistance in restoring your property. By taking quick action, you can prevent further destruction and save time and money in the long run.

Table Of Contents

1. Act Fast: Minimizing Damage After Your House Floods

2. Know Your Rights: Understanding Flood Zone Rules And Laws In Texas

3. Investing In Home Improvements To Reduce Risk Of Flooding

4. Repair Or Sell? Making The Right Decision For Your Flood-damaged House

5. Marketing Strategies For Selling A House With Flood Damage In Texas

6. The Benefits Of Partnering With A Knowledgeable Real Estate Agent During The Sale Process

7. How Do You Deal With A Flooded House?

Know Your Rights: Understanding Flood Zone Rules And Laws In Texas

If you live in Texas and are planning to sell your house with flood damage, it’s important to know the rules and laws regarding flood zones. In Texas, the Federal Emergency Management Agency (FEMA) designates areas as high-risk flood zones based on topography, hydrology, and other factors.

These zones establish the degree of flooding risk and may have an effect on your home’s sale. It is essential to comprehend these regulations in order to appropriately disclose any flood damage to prospective buyers and steer clear of future legal problems.

Additionally, homeowners should be aware of their rights when it comes to obtaining flood insurance and any mandatory disclosures required by state law. Educating yourself on flood zone rules and laws in Texas can help make the selling process smoother and more transparent for all parties involved.

Getting Elevation And Certification For Your Flood-prone Property

If you live in Texas and are looking to sell a house that has been damaged by floods, there are important steps you need to take in order to ensure a successful sale. One crucial aspect is getting elevation and certification for your flood-prone property.

This involves having a professional surveyor determine the elevation of your home and obtaining a Flood Elevation Certificate, which verifies the height of your property in relation to the Base Flood Elevation (BFE) determined by FEMA. This information is vital for potential buyers and can also help lower insurance premiums.

It is recommended to hire a certified surveyor with experience in flood-prone areas to accurately assess your property’s elevation. Additionally, obtaining a Letter of Map Amendment (LOMA) from FEMA can potentially remove your property from being classified as high-risk for flooding, increasing its marketability.

By taking these steps, you can provide valuable information and peace of mind to potential buyers while also maximizing the value of your flood-damaged home.

Disclosing Flood Zone Information To Potential Buyers

In Texas, homeowners who are selling a house that has flood damage must be conscious of their obligation to tell prospective buyers of any pertinent information regarding the property’s status as a flood zone. This is not only morally right but also required by law.

If the vendor withholds this information, there may be legal repercussions and reputational harm. In order to ensure that the listing accurately reflects the property’s position in a flood zone, homeowners should acquire all relevant documentation and data.

It is imperative that homeowners acquire knowledge about the many categories of flood zones and the potential effects they may have on the property’s worth. By being open and honest with prospective purchasers about information regarding flood zones, homeowners may foster confidence and facilitate a seamless selling process.

Investing In Home Improvements To Reduce Risk Of Flooding

When it comes to selling a house with flood damage in Texas, homeowners must be strategic in their approach. One key aspect is investing in home improvements that can help reduce the risk of flooding and make the property more appealing to potential buyers.

This entails taking steps like raising the base, putting in flood-resistant windows and doors, and setting up adequate drainage systems. Homeowners who undertake these upgrades may see an increase in offers from purchasers who appreciate flood mitigation in addition to a higher likelihood of selling their property quickly.

Additionally, investing in these improvements can provide peace of mind for both the current homeowners and future ones.

The Impact Of Flooding On Home Value: Understanding The Numbers

In Texas, flood damage can significantly lower a home’s value. It’s critical for homeowners to comprehend the numbers and how they may impact the selling process.

According to recent reports, homes with flood damage in Texas can see a decrease in value by 15-20%. This means that a house worth $300,000 could potentially lose $45,000-$60,000 in value due to flood damage.

Additionally, properties located in flood-prone areas may also face difficulty in finding buyers and could stay on the market for longer periods of time. It’s crucial for homeowners to be aware of these numbers and strategize accordingly when selling their homes with flood damage.

Repair Or Sell? Making The Right Decision For Your Flood-damaged House

When it comes to selling a property with flood damage in Texas, homeowners are faced with the tough decision of whether to repair their property or sell it as-is. This decision ultimately depends on various factors, such as the extent of the damage, the current real estate market, and the homeowner’s financial situation.

Repairing the house and then selling it could result in a higher sale price if the damage is minor and fixable at a fair price. On the other hand, it can be more financially viable to sell the house as-is if the damage is severe and expensive to fix.

Homeowners should also consider if they have flood insurance coverage and how long it will take for repairs to be completed. Ultimately, carefully weighing all options and seeking professional advice can help homeowners make the right decision for their flood-damaged house in Texas.

Selling A Flood-damaged House: Challenges And Strategies To Consider

Selling a home with flood damage can be daunting for homeowners in Texas. Not only do they have to deal with the emotional toll of losing their home, but they also have to deal with the practical challenges of finding potential buyers and negotiating a fair price.

The potential effect that flood damage may have on the home’s value is one of the primary worries. Due to possible health and safety risks, buyers could be reluctant to buy a house that has experienced floods.

In addition, it can be costly and time-consuming to replace or repair damaged house components. Homeowners can, however, take several precautions to improve their chances of successfully selling a flood-damaged property.

These include proper documentation of repairs, hiring experienced real estate agents, and being transparent about the extent of damage during negotiations.

Making Sense Of Repairing Vs. Selling A Flooded Home In TX

When faced with the dilemma of a flooded home in Texas, homeowners may wonder whether it is better to repair their property or sell it as-is. While both options have their own advantages and disadvantages, it ultimately comes down to the individual circumstances of each homeowner.

Repairing a flooded home can be costly and time-consuming, but it allows homeowners to keep their property and potentially increase its value. On the other hand, selling a flooded home means taking a financial loss, but it also relieves homeowners from the responsibility of repairs and potential future flooding.

Ultimately, homeowners should carefully consider their options and weigh the costs and benefits before deciding whether to repair or sell their flood-damaged home in Texas.

Pricing Strategies For Selling A Home With Flood Damage

When it comes to selling a house with flood damage in Texas, determining the right price can be a daunting task for homeowners. However, there are several pricing strategies that can help you get the best value for your property despite the damage.

The first step is to assess the extent of the flood damage and factor in any repairs or renovations that may be needed. Next, research similar properties in your area that have been sold with flood damage and take note of their prices.

This can help you determine how much these homes are now worth on the market. Additionally, if you want an accurate home appraisal, think about employing a professional appraiser.

Finally, be prepared to negotiate with potential buyers and be open to adjusting your price if necessary. By utilizing these pricing strategies, homeowners can successfully sell their flood-damaged homes in Texas for a fair price.

Marketing Strategies For Selling A House With Flood Damage In Texas

When it comes to selling a house with flood damage in Texas, marketing strategies play a crucial role in attracting potential buyers. As a homeowner, it is important to highlight the unique aspects of your property and showcase its potential despite the damage caused by flooding.

This can be achieved through the strategic use of keywords in online listings and advertisements, emphasizing any repairs or renovations done to mitigate the effects of flood damage. Utilizing social media platforms, such as Facebook and Instagram, can also help reach a wider audience and showcase the property’s strengths.

The whole marketing plan can also be substantially enhanced by collaborating with neighborhood real estate brokers who are knowledgeable about the area and have sold homes that have sustained flood damage. By putting these marketing techniques into practice, homeowners in Texas can improve the likelihood that their flood-damaged properties will be sold at a fair price.

Working With Buyers Who Are Willing To Take On Risky Properties

When it comes to selling a house with flood damage in Texas, homeowners may find themselves facing a unique set of challenges. One of the biggest hurdles is finding buyers who are willing to take on risky properties.

These buyers understand the potential risks and difficulties that come with purchasing a flood-damaged home, but they are still interested in making the investment. As a homeowner, it’s important to work closely with these buyers and be transparent about the extent of the damage and any necessary repairs.

You may improve your chances of finding a buyer who is prepared to take on a risky property and successfully sell your flooded home in Texas by giving thorough information and remaining open to talks.

The Benefits Of Partnering With A Knowledgeable Real Estate Agent During The Sale Process

Selling a house with flood damage in Texas can be a daunting task, but it doesn’t have to be. By partnering with a knowledgeable real estate agent, homeowners can benefit greatly during the sale process.

These agents have extensive experience and expertise in dealing with properties affected by flood damage. They can provide valuable insights and strategies to help homeowners navigate the complexities of selling such a property. From determining the right listing price to marketing the property effectively, a skilled real estate agent can make all the difference in ensuring a successful sale.

They also have access to a wide network of potential buyers, which increases the chances of finding the right buyer for the damaged property. Furthermore, their negotiation skills and knowledge of relevant laws and regulations can help protect homeowners from any legal or financial complications that may arise during the sale process.

Overall, partnering with a knowledgeable real estate agent is essential for homeowners looking to sell their flood-damaged house in Texas efficiently and effectively.

Do You Have To Disclose If A House Has Flooded In Texas?

As a homeowner in Texas, it’s important to understand the laws and regulations surrounding flood damage when selling your property. One of the most common questions asked is whether or not you are required to disclose if your house has flooded in the past.

Yes, to put it briefly. Potential buyers must be informed of this information. Sellers must disclose any known material flaws, including flood damage, in accordance with Texas law.

If this isn’t done, there may be legal repercussions and buyer lawsuits. But, there are methods and advice that Texas homeowners can employ when listing a home with flood damage; we’ll go over them all in this comprehensive guide.

How Does Flooding Affect Property Value?

Flood damage is a major concern for homeowners in Texas, especially when it comes to selling their property. The effects of flooding on property value can be significant and should not be overlooked.

Because of the possible hazards and expenses involved in repairing and preventing further floods, a house that has had flood damage may lose value. This lowers the property’s total worth and may make it harder to draw in prospective purchasers.

However, with proper preparation and strategies, homeowners can minimize the negative impact of flooding on their property’s value and successfully sell their home in Texas.

How Much Water Counts As A Flood?

When it comes to selling a house with flood damage in Texas, one of the most pressing concerns for homeowners is determining how much water actually counts as a flood. According to the Federal Emergency Management Agency (FEMA), a flood is defined as any water that covers at least two acres of land or affects two or more properties.

However, in Texas, this definition may vary depending on the specific county and its regulations. Homeowners should carefully assess the extent of water damage and consult with local authorities to accurately determine if their property has been affected by a flood.

Homeowners can successfully traverse the Texas flood damage sales process by being aware of these requirements and collaborating with knowledgeable experts.

How Do You Deal With A Flooded House?

Dealing with a flooded house can be a daunting task for any homeowner, especially in the state of Texas, where flooding is a common occurrence. However, with the right knowledge and strategies, selling a property with flood damage can be a manageable and successful process.

Finding out how much damage there is and whether repairs are possible or if selling it as-is would be a more economical course of action is the first step. Next, it’s critical to comprehend the legal obligations surrounding the disclosure of flood damage in Texas real estate transactions.

This involves getting the right permits for any repairs done and giving prospective buyers a copy of the Flood Insurance Rate Map (FIRM). Furthermore, homeowners want to think about working with a respectable real estate broker with knowledge of handling flood-damaged homes.

Homeowners can successfully navigate the difficulties of selling a flooded house in Texas and achieve a successful sale by heeding the advice and techniques provided here.

More Texas Resources For Homeowners

| Sell A House With Flood Damage | Selling A TX House With Septic Issues |

| Broken Water Main To House In Texas | Water Main Leak Cost In Texas |

Get Cash For Your Texas House Today

We buy houses in Texas without the hassle and red tape. Get your no-obligation cash offer for your home and just be done. Selling in as-is condition has never been easier.

| FLOOD PLAINS | PRIVATE INSURANCE | INSURANCE AGENTS | INSURER | POLICYHOLDER | HOUSTONIANS |

| HOUSTON, TEXAS | FEDERAL FLOOD INSURANCE | NATIONAL FLOOD INSURANCE PROGRAM | NFIP | SPECIAL FLOOD HAZARD AREAS | FEMA’S |

| INVESTOR | CASH | MOLD | SMALL BUSINESS ADMINISTRATION | U.S. SMALL BUSINESS ADMINISTRATION | |

| SBA | U.S. | AMERICAN | RESERVOIR | POLICY | MOLD REMEDIATION |

| FORECLOSES | FORECLOSURE | HURRICANE | MORTGAGE | FOREIGN INVESTORS | INSURANCE POLICY |

| HURRICANE HARVEY | HOME INSPECTOR | HOME INSPECTION | CLIMATE CHANGE | A REAL ESTATE AGENT |